Do you want to know how to get loan from Moniepoint? Don’t worry, this post is for you. With this article, you will have no problem concerning how to get Moniepoint to approve your loan request. All you need to do is read further and pay close attention to the details I am about to present.

It is a typical hot sunny afternoon in Uyo, and Charity is sitting in his provision shop with the eagerness of a salesman. “Ping”, his phone notification goes off, and with excitement in his eyes, he reads the approval email for her loan.

However, his joy vanishes when he sees the high interest rate on the loan. Charity’s story is not uncommon, with Nigeria’s average bank lending rate hovering around 18.49% per annum; she’s not the only one taking out loans at a cost

Loans are important for boosting your business, funding your education, and handling emergencies, but it is essential to know the ropes of getting one so as not to fall into the trap of bad debt. In this post, I’ll explore 10 smart rules every Nigerian should know before taking a Loan.

What is a Loan and How Does it Work?

A Loan is money you get from a lender, such as a bank, online lender, or credit union, with an agreement to pay it back over time, typically with interest.

The repayment terms, interest rates, terms and conditions, etc, are usually agreed upon before the loan is given to the borrower. Whether you’re dealing with family emergencies or growing your business, a loan can be helpful if you use it wisely.

How to Get a Loan

Before you apply for that loan, here are a few things to consider;

- Make your need known: Are you getting the loan for school fees, emergencies, or business purposes? This will determine the kind of loan you need to apply for.

- Examine your eligibility: Things that can determine your loan eligibility are your income, credit history, existing debts, and other relevant financial information.

- Application: Apply for the loan by submitting the necessary documents to your potential lending platform.

- Approval: If you meet the lender’s criteria, the loan is approved

- Disbursement: After the loan is approved, the loan amount will be disbursed to you either in lump sums or instalments.

- Repayment: You pay back the loan over a specified period, which includes both the principal (the original loan amount) and the interest.

The procedure looks straightforward, right? That is how it is supposed to be. However, it can be tricky and complicated if you do not pay attention to hidden charges, unrealistic repayment periods, or penalties.

5 Rules for Taking out a Safe Loan in Nigeria

Before you jump into any loan, take a look at this. A wrong loan can stress your business, but a right one can help you grow with ease. These 5 simple rules will help you borrow wisely, avoid hidden traps, and make better money moves.

1. Properly Understand the Real Cost of the Loan Before Taking the Loan

When borrowing, do not just look at the entire amount of the loan; consider everything you’ll have to repay. This covers charges for setting up the loan, interest rates, and late payment penalties.

For instance, let us say you borrow N1 million with an interest rate of 3% per month; you will have to pay back N30,000 monthly. Other factors to consider are the loan clauses, terms and conditions, and any additional charges beyond the interest rate.

2. Don’t Be in a Haste, Compare your Loan Options First

Ensure you compare your loan options carefully before applying. While some options might charge hidden fees, others can delay disbursements. Compare lending institutions, such as banks, fintech companies, and cooperative societies.

Consider their numerous interest rates, flexible repayment terms, customer support, and other factors to save yourself significant money in the long run.

3. Know Your Credit Score and Why It Matters

Your credit score is an important factor in determining whether lenders will approve your loan and how reliable you are in repaying it. Increase your credit score by regularly checking it and paying off any outstanding debts.

In Nigeria, you can easily check your credit score on the CRC Credit Bureau. Simply dial 5658# to receive one free credit report per year.

4. Have a Clear Repayment Plan

Before signing off on that application form and proceeding to submit it, make sure to ask yourself if you have a realistic and clear repayment plan. Before you borrow, break down your monthly earnings and weekly sales, and clearly outline how much you can repay monthly.

Late repayments can lead to penalties and fines, which can damage your credit history and hinder future loan opportunities. Only commit to taking out a loan once you have verified that you can pay it back on time.

5. Only Borrow What You Truly Need

It can be tempting to borrow more than what you need, especially when it’s given to you.

Remember that each money borrowed comes with an interest attached, which can cause financial stress when repaying if not properly planned. You should take out a loan to solve problems, not to go on a shopping spree.

Where to Take the Best Loans

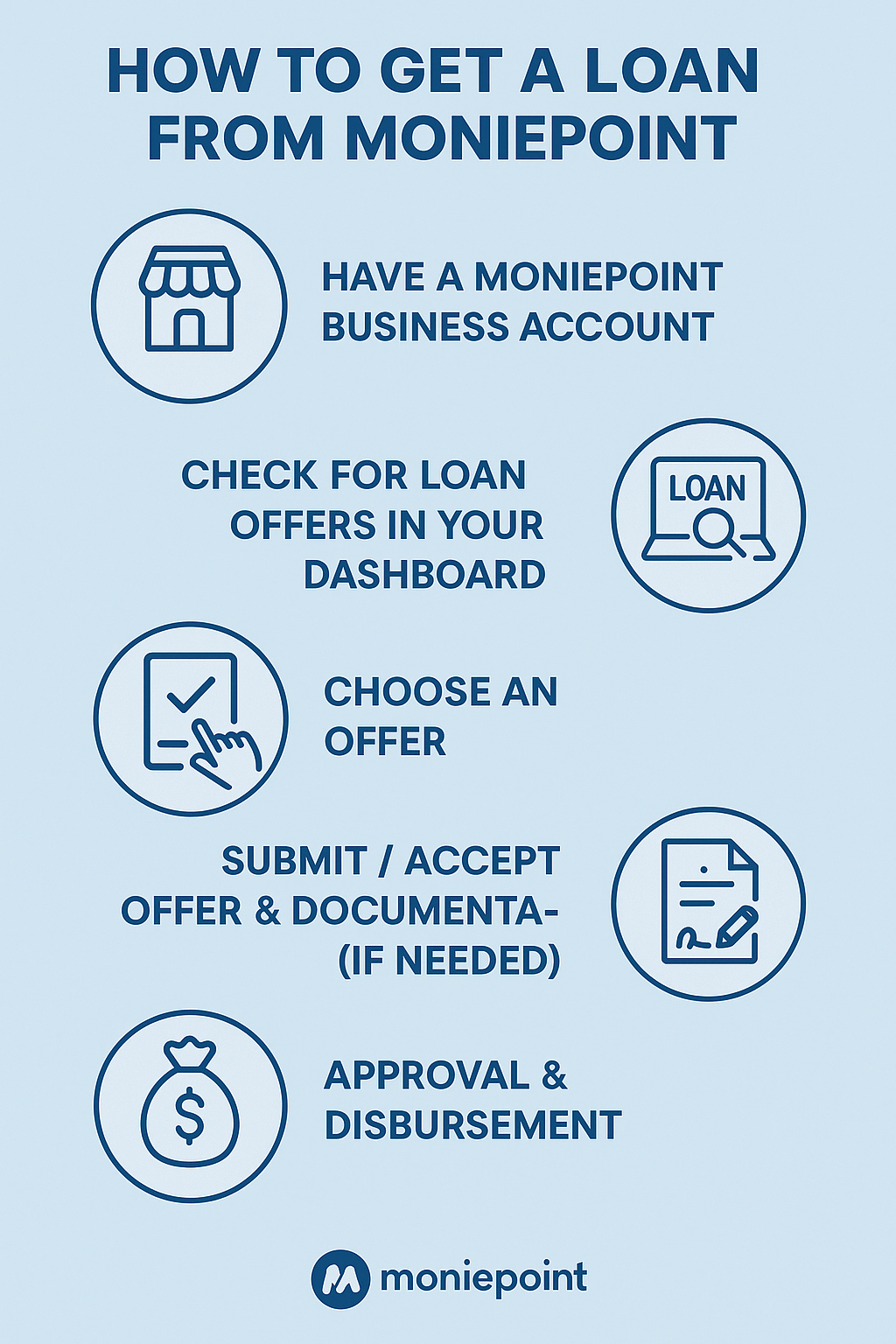

Running a business is hard; sometimes, you just need cash to stock up or address urgent demands. That’s where Moniepoint Working Capital Loans are necessary. You can get a loan ranging from ₦1 million upwards with no collateral.

The interest rate is fair (approximately 20–40% per annum), and you can expect to receive the money within one to three days after approval. Repayment is also flexible—you pay in instalments based on your sales.

Everything takes place from your Moniepoint business dashboard. There is no paperwork. No long discussion. Just money when you need it to keep your business going.

Conclusion

Taking a loan can help your business improve, but only if you do it correctly. Always understand the full cost, compare lenders, review the repayment terms, and borrow only what you need with a solid plan to repay.

Borrowing smartly is part of smart business. Are you ready to take control of your business finances?

Sign up on the Moniepoint Business Bank app today and apply for a collateral-free loan built to support your hustle.